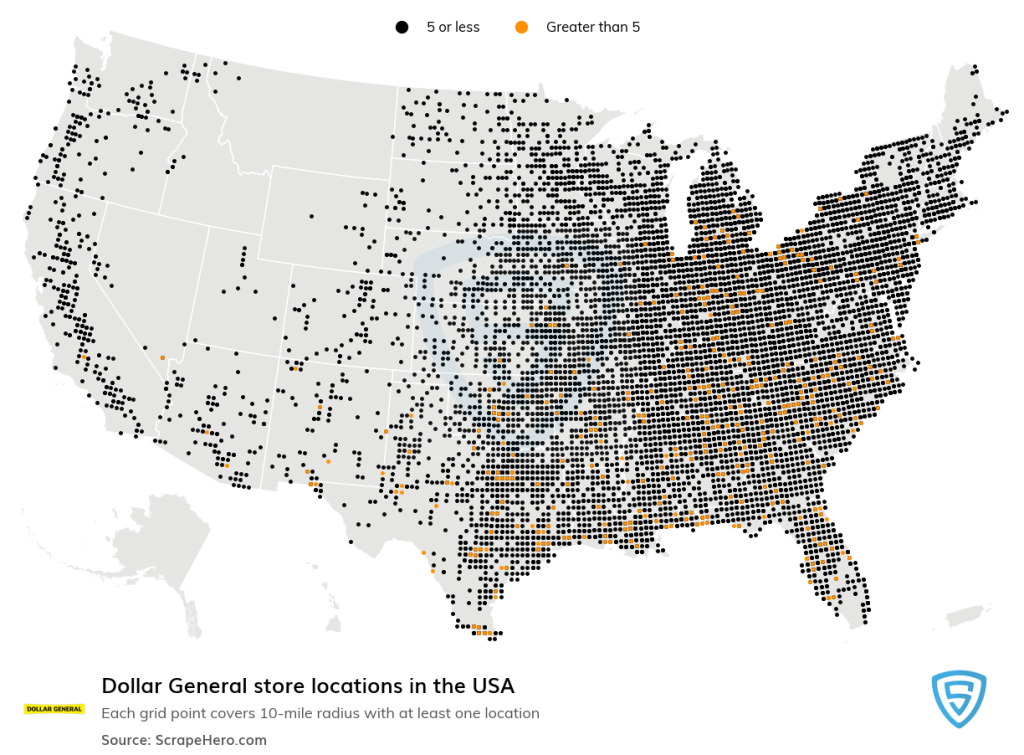

While 99 Cents Only may have had a smaller scale, its closure presents significant opportunities for competitors. The relatively fewer number of 99 Cents Only Stores was a primary factor in its downfall, as high sales volumes and economies of scale play crucial roles in value-oriented retail.

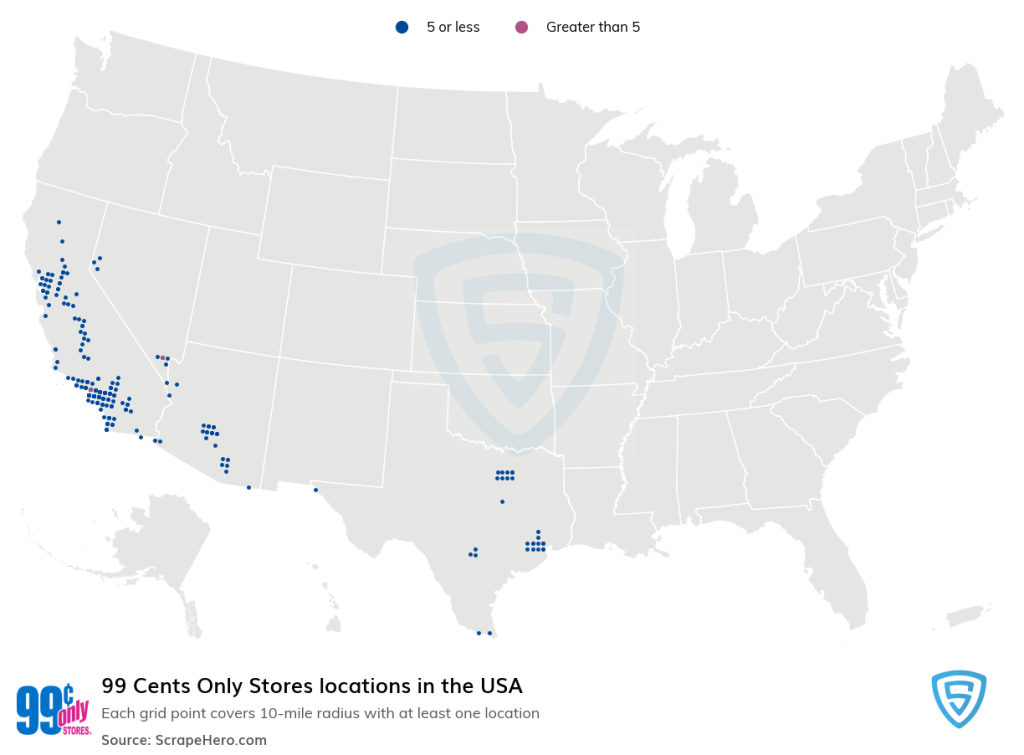

Operating approximately 370 stores in Texas, California, Nevada, and Arizona, the discount retailer’s decision to file for bankruptcy and liquidate opens up opportunities for other discount stores, with Dollar Tree poised to reap the greatest benefits. Looking ahead, there are substantial opportunities for market share growth, given considerable overlap between these two dollar stores.

For instance, according to Earnest credit card data, over 77% of 99 Cents Only customers also shop at Dollar Tree in the past 12 months. Furthermore, nearly all (99%) of 99 Cents Only stores have a Dollar Tree within a 5-mile radius, with over half (57%) of stores being less than a mile apart. In comparison, based on Jefferies real estate analysis, 60% of 99 Cents Only stores are within five miles of Family Dollar, 75% within five miles of Five Below, and 49% within five miles of Dollar General.

Earnest’s data shows that Five Below, Dollar General, and Big Lots each capture over a quarter of 99 Cents Only customers and are also poised to benefit. Jefferies also found overlapping customer profiles among Family Dollar, Dollar General, and 99 Cents Only. Consequently, 37% of 99 Cents Only customers have annual incomes of $40,000 or less, compared to 44% for Family Dollar and 35% for Dollar General.

Dollar General’s expansion plans could bolster its market share. With approximately 20,000 stores in operation, Dollar General plans to open 800 new stores this year alone, many of which may be located in the western regions where Dollar General’s penetration is relatively low compared to 99 Cents Only’s dominance. Presently, Dollar Tree stands as the retailer with the most overlap with 99 Cents Only Stores, implying it may attract the most customers in Southern California and Texas.

Among discount retailers, Five Below is the least likely to benefit from the disappearance of 99 Cents Only, primarily due to differing customer bases, with nearly 40% of Five Below customers having annual incomes exceeding $100,000, compared to just over a quarter for 99 Cents Only customers. Additionally, Five Below has the least geographical overlap, with just over half of its stores located within a five-mile radius of 99 Cents Only stores.