US April Retail Sales Miss Expectations, Supporting Prospect of Fed Rate Cut

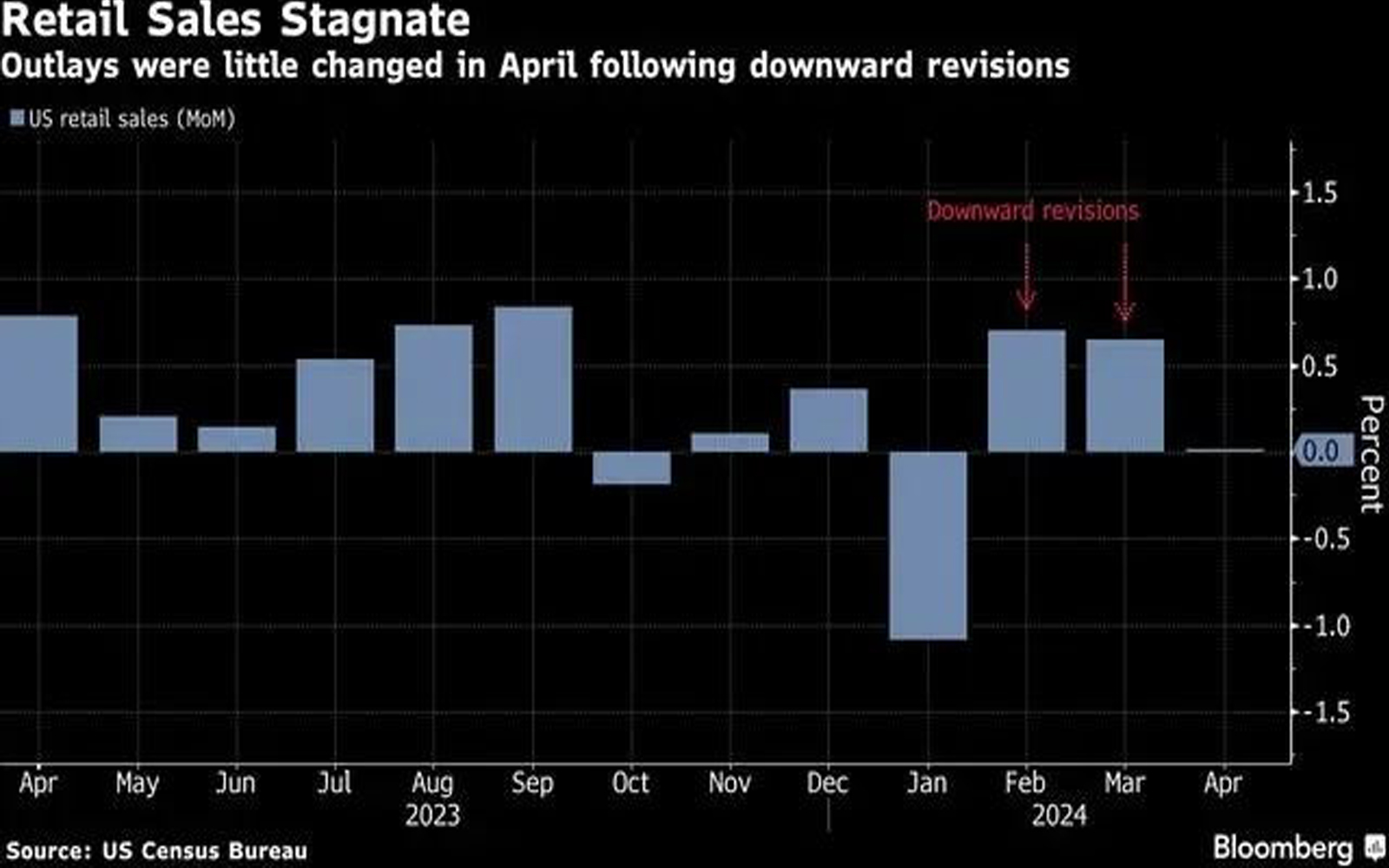

US retail sales for April unexpectedly remained flat month-on-month, and the growth data for the previous month was also revised downward. This indicates that persistently high borrowing costs and increasing debt are making consumers more cautious. Data released on Wednesday showed that US retail sales grew 0% from the previous month, falling short of the market expectation of 0.4% and lower than the downward-revised 0.6% in March. The April retail sales data suggests that the previously robust consumer demand is softening, which has been supporting the US economy. Despite a strong labor market that provides necessary funds for consumption, high prices and interest rates may further squeeze US household finances and limit discretionary spending.

The New York Fed stated on Tuesday that US household debt reached a new record high in the first quarter, and the proportion of consumers struggling to repay their debts increased. Meanwhile, data also released on Wednesday showed that core CPI for April met expectations, decreasing from 0.4% to 0.3% month-on-month, and pushing the year-on-year core CPI increase down from 3.8% in March to 3.6%. Overall CPI also decreased from 0.4% to 0.3% month-on-month, slightly below expectations, with the year-on-year increase dropping from 3.5% to 3.4%.

Gregory Faranello, a strategist at AmeriVet Securities, stated that the CPI and retail sales data are favorable for the Federal Reserve as both indicate the inflation moderation that the Fed is seeking. These numbers will support Fed Chair Powell’s shift in views from “maintaining higher rates for longer” to “possibly cutting rates.”